At Osa Property Management, we often field questions about property management fee averages. Understanding these costs is essential for property owners looking to maximize their investment returns.

Property management fees can vary widely based on several factors, including location, property type, and the scope of services provided. In this post, we’ll break down the typical fee structures and provide insights into what you can expect to pay for professional property management services.

What Are Property Management Fees?

Definition and Purpose

Property management fees represent the costs associated with hiring a professional company to oversee and maintain rental properties. These fees cover a range of services that property managers provide to ensure investments run smoothly and profitably.

Common Fee Structures

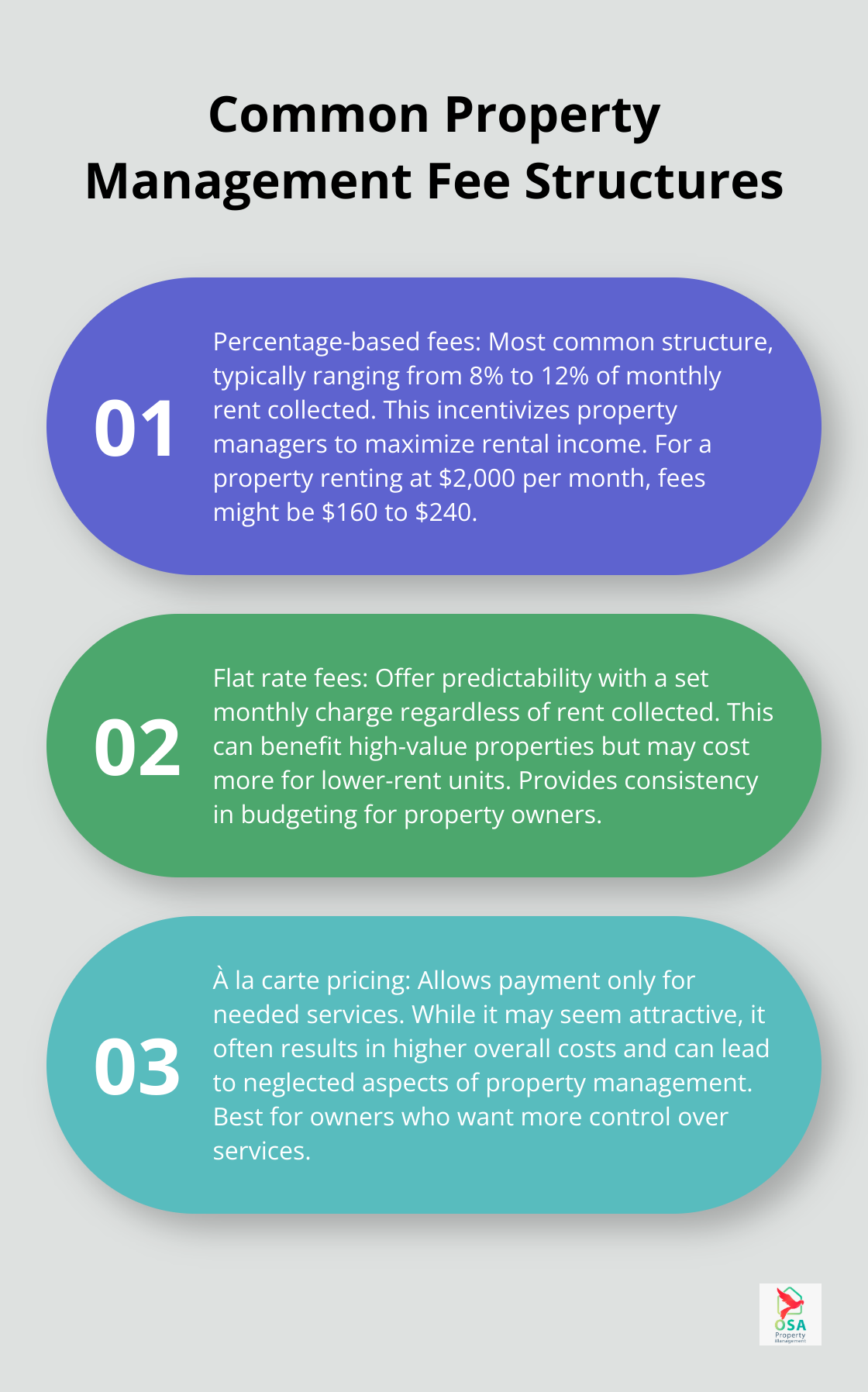

Property management companies typically use one of three fee structures:

Factors Influencing Fee Rates

Several factors impact property management fees:

- Property type and size: Single-family homes often have lower fees compared to multi-unit buildings or commercial properties.

- Location: Urban areas with higher property values and rents typically command higher management fees.

- Property condition: Older or poorly maintained properties may incur higher fees due to increased management time and maintenance needs.

- Services included: Comprehensive packages covering everything from tenant screening to maintenance coordination will cost more than basic services.

- Local market conditions: Competitive markets may drive fees down, while areas with few property management options might see higher rates.

Value vs. Cost Considerations

When evaluating property management services, it’s important to look beyond just the fee percentage. A company that offers comprehensive services and local expertise can often lead to better returns on investment through higher occupancy rates, quality tenants, and well-maintained properties.

Companies like Osa Property Management, with their extensive experience in Costa Rica, provide tailored services that can justify slightly higher fees through improved property performance and reduced owner stress.

As we move forward, let’s examine the average property management fee percentages across different property types and locations to give you a clearer picture of what to expect.

What Are Average Property Management Fees?

Residential Property Fee Ranges

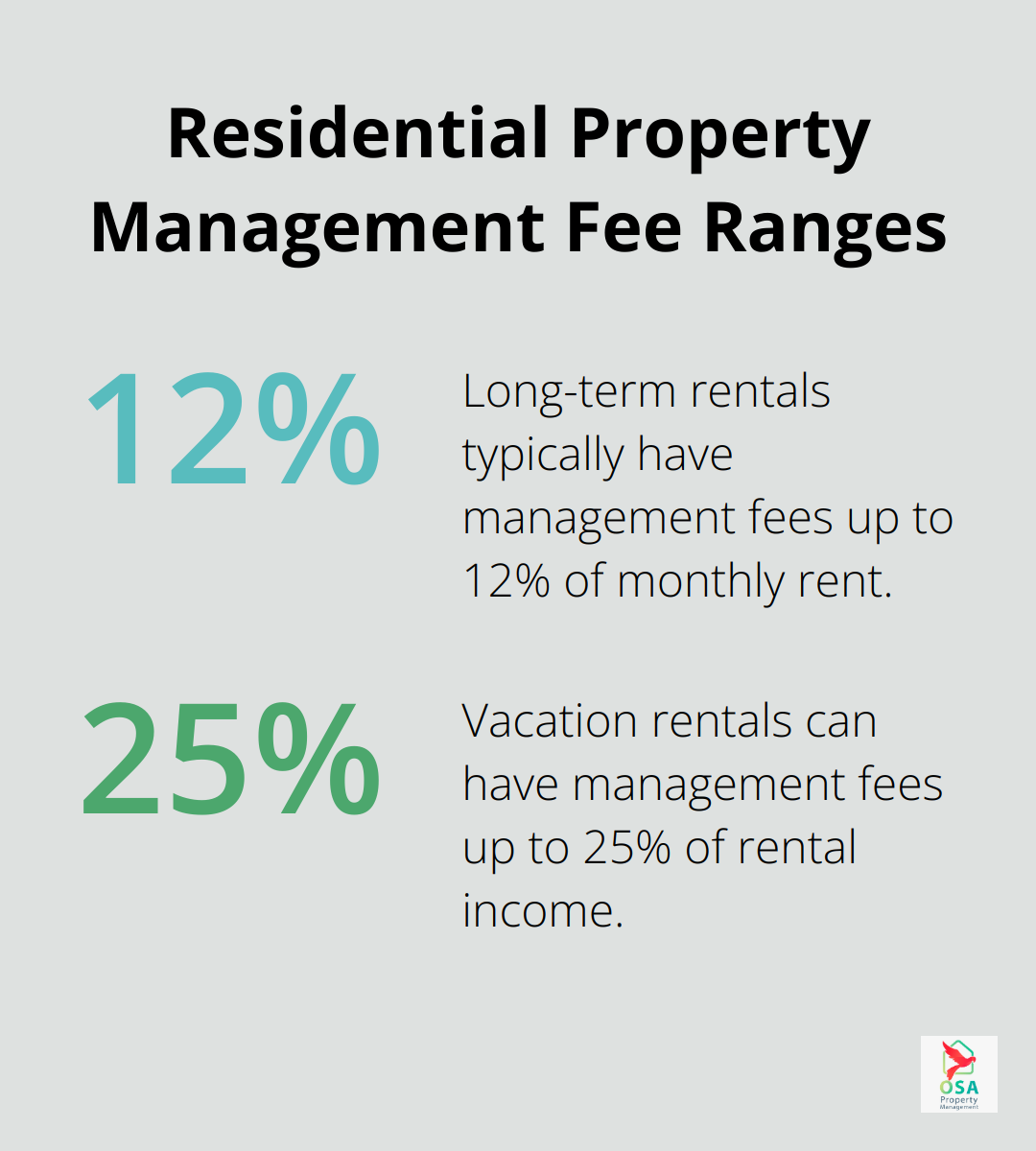

Property management fees vary based on several factors. The average fee for residential properties typically falls between 8% and 12% of the monthly rent collected. Single-family homes often see fees on the lower end, around 8-10%, due to less intensive management requirements. Apartment complexes or large multi-family properties might incur fees closer to 10-12% because of increased management complexity.

High-cost-of-living areas like San Francisco or New York City might have slightly lower percentage fees (often around 6-8%). This occurs because higher rental rates allow management companies to charge a lower percentage while covering their costs. Smaller cities or rural areas might see fees towards the higher end of the range to compensate for lower rental incomes.

Impact of Property Type on Fees

The type of property significantly influences management fees. Commercial properties often command higher fees (10-15% of collected rent) due to complex lease agreements and specialized knowledge requirements. Luxury properties or those with extensive amenities might see fees reaching 15-20% of collected rent. These higher fees reflect the need for more hands-on management, frequent inspections, and higher levels of tenant service.

Long-Term vs. Vacation Rental Fees

Long-term rental management fees typically range from 8-12%, while vacation rental management fees are substantially higher, often between 15% to 25% of rental income. This stark difference stems from the increased workload associated with vacation rentals. Managers of vacation properties must handle frequent turnovers, intensive marketing, and higher levels of guest service. They also often manage additional services like cleaning, restocking supplies, and coordinating online bookings across multiple platforms.

For example, a vacation rental in a popular tourist destination might incur management fees of up to 40%, reflecting the additional work required to manage bookings, coordinate cleanings between guests, and provide concierge services.

Customized Fee Structures

While these percentages provide general guidelines, actual fees can vary. Some management companies offer customized packages that affect the overall fee structure. When evaluating property management services, it’s essential to consider more than just the percentage. The value and peace of mind that professional management provides should also factor into your decision.

As we explore property management fees further, it’s important to understand that these base fees often don’t tell the whole story. Many companies charge additional fees for specific services, which can significantly impact the total cost of property management. Let’s examine these additional costs and services in the next section.

Hidden Costs in Property Management

Leasing and Tenant Placement Fees

Property management fees often extend beyond the basic monthly percentage or flat rate. One of the most significant extra charges is the tenant placement fee. This fee typically ranges from 50% to 100% of one month’s rent. It covers the costs of marketing the property, screening potential tenants, and handling the move-in process. Some companies charge this fee each time a new tenant moves in, while others may offer a reduced rate for lease renewals.

For example, if your property rents for $1,500 per month, you might pay a one-time fee of $750 to $1,500 when a new tenant moves in. This fee compensates the management company for the time and resources invested in finding a quality tenant (which can ultimately save you money by reducing vacancy periods and potential evictions).

Maintenance and Repair Costs

Maintenance costs are another area where additional fees can accumulate. While routine maintenance is often included in the base management fee, many companies charge extra for coordinating repairs or renovations. Property management fee structures are usually a percentage of the monthly rent, between 4% and 15%.

Some management companies have in-house maintenance staff, which can be more cost-effective for property owners. Others work with a network of trusted contractors.

Additional Service Charges

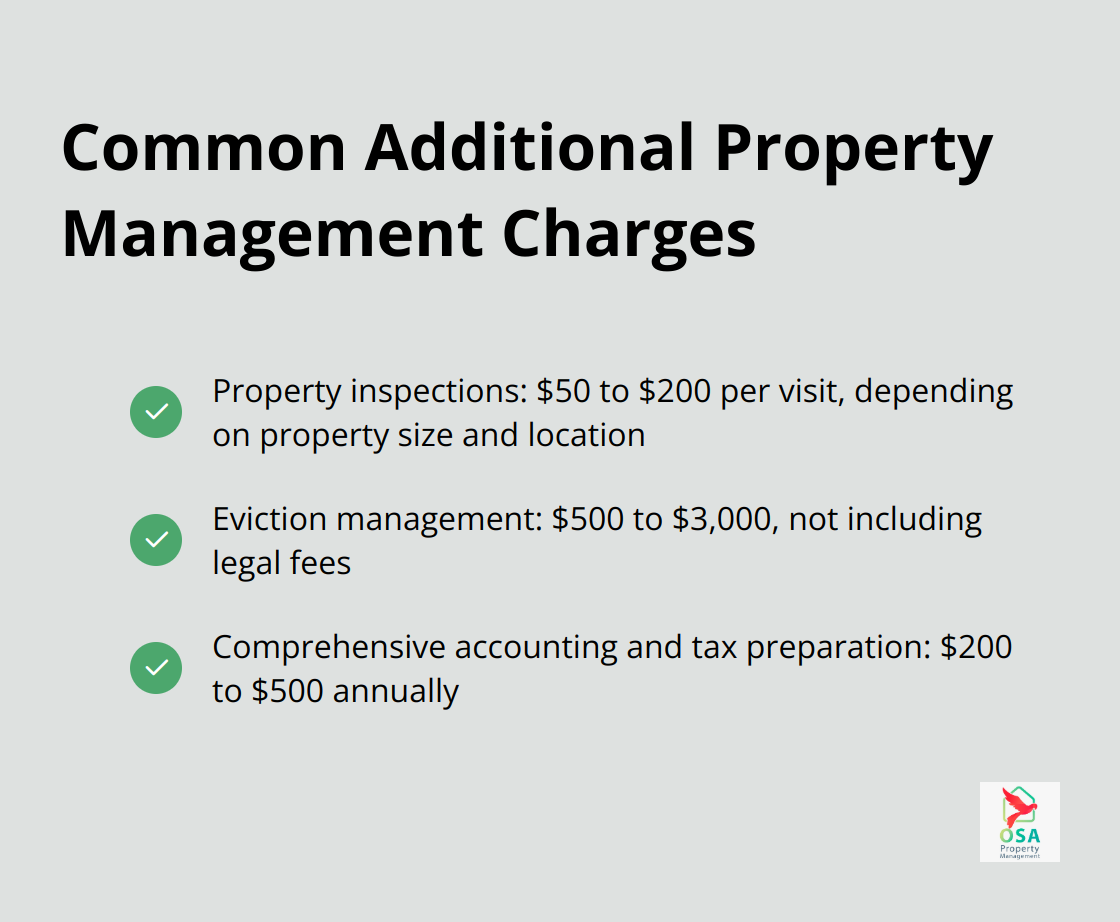

Property inspections, eviction management, and detailed accounting services often come with separate fees. Regular property inspections might cost $50 to $200 per visit, depending on the property’s size and location. Eviction services can range from $500 to $3,000, not including legal fees. Comprehensive accounting and tax preparation services might add another $200 to $500 annually.

Some management companies charge for these services à la carte, while others include them in higher-tier service packages. It’s important to understand which services are included in your base fee and which will incur additional charges.

Impact of Location and Property Type

The extent and cost of additional services can vary significantly based on your property’s location and type. For instance, vacation rentals in tourist hotspots might require more frequent inspections and maintenance due to higher turnover rates. Similarly, luxury properties often demand more intensive management and concierge services, which can lead to higher overall costs.

Understanding these potential additional costs is important when you budget for property management services. While they may seem daunting at first, many of these services can actually save you money in the long run by protecting your investment and maximizing your rental income. When you evaluate property management companies, look beyond the base fee and consider the full range of services offered and their associated costs.

Final Thoughts

Property management fee averages typically range from 8% to 12% of monthly rent for residential properties, with variations based on location, property type, and services provided. Vacation rentals often command higher fees, ranging from 15% to 25% due to increased management demands. These base percentages don’t tell the whole story, as additional costs for tenant placement, maintenance, and other services can significantly impact the overall expense.

When evaluating property management services, look beyond the basic fee structure and consider the value provided through comprehensive services, local expertise, and potential for increased rental income. A slightly higher fee might result in better returns through improved property performance and reduced stress for owners (this is especially true for complex or high-value properties). Thoroughly review contracts and ask detailed questions about included services and additional costs to make an informed decision.

Osa Property Management offers customized packages designed to maximize your investment while providing peace of mind. Our team handles everything from marketing and tenant relations to bill payment and tax compliance, ensuring a smooth and profitable property management experience. We invite you to contact us to discuss how we can tailor our services to meet your specific property management needs.