Costa Rica’s IVA (Impuesto al Valor Agregado) tax has significant implications for property owners in the country. This value-added tax affects various aspects of real estate ownership, from rental income to property management costs.

At Osa Property Management, we’ve seen firsthand how the implementation of IVA has changed the landscape for our clients. Understanding this tax is essential for anyone invested in Costa Rican real estate, as it directly impacts your bottom line and future investment strategies.

What is Costa Rica’s IVA Tax?

The Basics of IVA

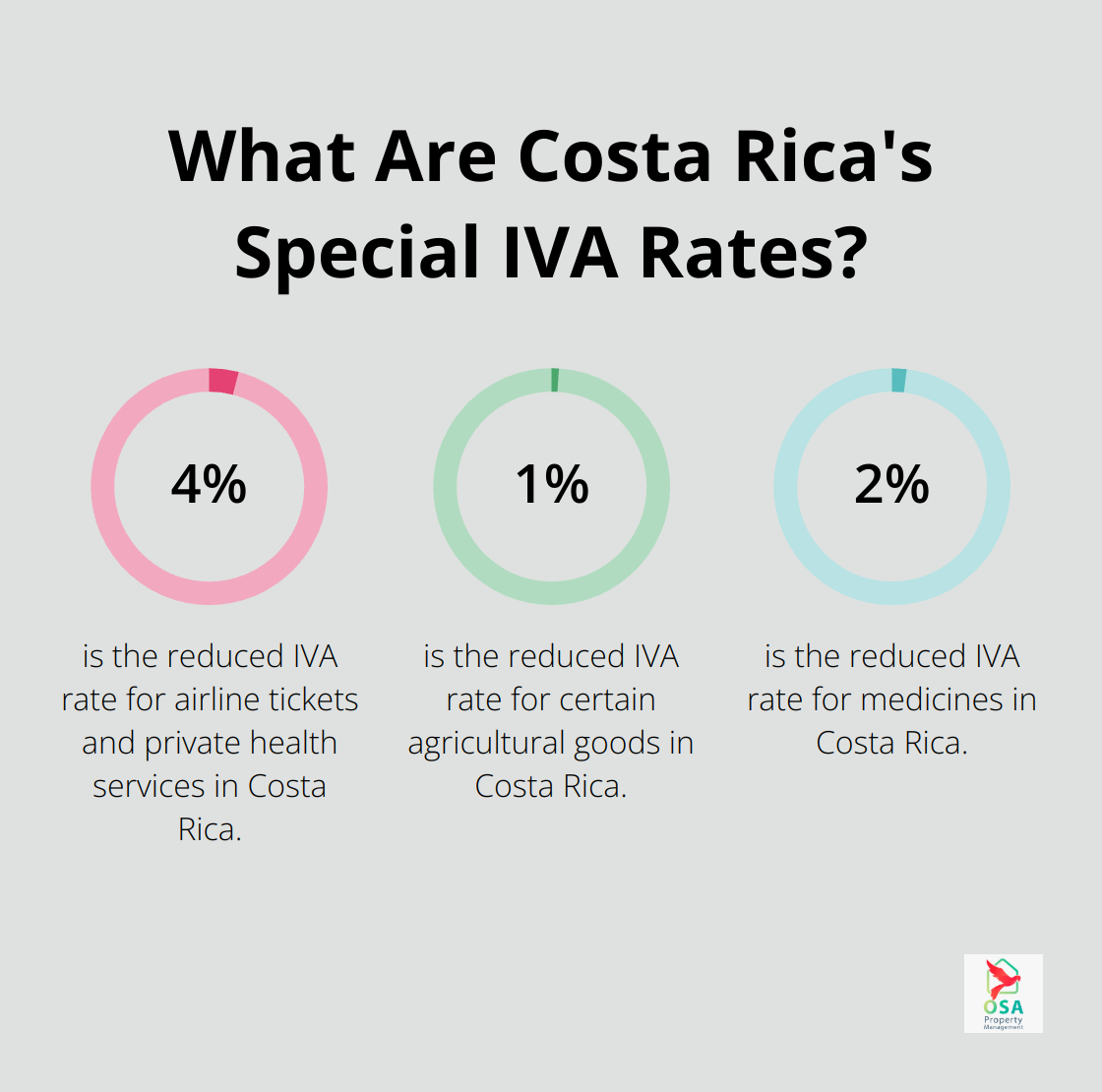

Costa Rica’s IVA (Impuesto al Valor Agregado) tax, implemented on July 1, 2019, replaced the previous General Sales Tax (GST). This value-added tax applies to most goods and services at a standard rate of 13%. Specific sectors benefit from reduced rates: 4% for airline tickets and private health services, 2% for medicines, and 1% for certain agricultural goods. These rates position Costa Rica competitively within the region (e.g., Nicaragua and Honduras have a 15% VAT rate).

Key Changes from Previous Tax Systems

The IVA marks a significant shift from the old GST system. It expands the tax base to include professional services and digital products, directly affecting property owners. Many previously untaxed real estate-related services now fall under the IVA umbrella, creating new financial considerations for investors and homeowners.

Impact on Short-Term vs. Long-Term Rentals

The introduction of IVA created a notable distinction in the rental market. Short-term property rentals (less than one month) now incur the standard 13% IVA, while long-term residential rentals remain exempt. This change prompts property owners to reassess their rental strategies, with some opting to convert vacation rentals to long-term leases to avoid the tax burden.

Compliance and Record-Keeping Requirements

IVA implementation brought new compliance measures. All VAT-registered entities must now use electronic invoices, a system introduced in 2018 to enhance tax transparency. Property owners must maintain detailed records for a minimum of four years and adapt to new digital systems for tax reporting. These changes (while initially challenging) aim to streamline tax processes and improve overall fiscal management.

International Implications

The IVA system affects not only local property owners but also international investors. This international aspect underscores the importance of understanding IVA for foreign property investors in Costa Rica.

The implementation of IVA has reshaped Costa Rica’s tax landscape, particularly for property owners. As we move forward, we’ll explore how these changes specifically impact property-related costs and market dynamics in the Costa Rican real estate sector.

How IVA Impacts Property Owners in Costa Rica

Increased Costs for Property-Related Services

The introduction of IVA in Costa Rica has altered the financial landscape for property owners. Many services essential to property maintenance and operation now incur a 0.25% property tax, increasing overall expenses. For instance, a property renovation that previously cost $10,000 now costs $10,025 with the added property tax.

This cost increase has prompted property owners to reassess their budgets and seek cost-effective solutions. Some opt for preventive maintenance strategies to reduce major repair frequency, while others explore bulk purchasing of supplies to mitigate the impact of taxes on expenses.

Shifts in Rental Income Strategies

IVA has created a notable divide in the rental market. Short-term rentals (less than 30 days) now face a 13% tax, while long-term rentals remain exempt. This distinction has led to a shift in rental strategies among property owners.

Many vacation rental owners have seen their profit margins decrease as they either absorb the tax or pass it on to renters, potentially making their properties less competitive. As a result, some have transitioned to offering long-term rentals to avoid the IVA burden altogether.

Adaptation of Property Management Services

Property management companies have adapted their services and pricing structures to accommodate these changes. New accounting practices and digital tools ensure accurate tax collection and reporting for clients, helping them navigate this complex tax landscape.

Market Dynamics and Property Values

IVA implementation has influenced property values and market dynamics in Costa Rica. The increased costs associated with property ownership and management have put upward pressure on property prices, particularly in popular tourist areas where short-term rentals are common.

However, this trend isn’t uniform across all regions. In some areas, property values have stabilized as the market adjusts to the new tax reality. Buyers are now more discerning, factoring in potential tax implications when assessing property investments.

Shift in Investment Focus

The tax system has spurred interest in properties that offer potential for long-term rentals, as investors seek to capitalize on the tax exemption for these types of leases. This shift has led to increased demand for residential properties in areas popular with expats and long-term visitors.

As the Costa Rican real estate market continues to evolve under the current tax system, property owners must stay informed and adaptable. The next section will explore strategies that property owners can employ to navigate these new tax realities effectively.

Navigating IVA: Smart Strategies for Property Owners

Embrace Digital Record-Keeping

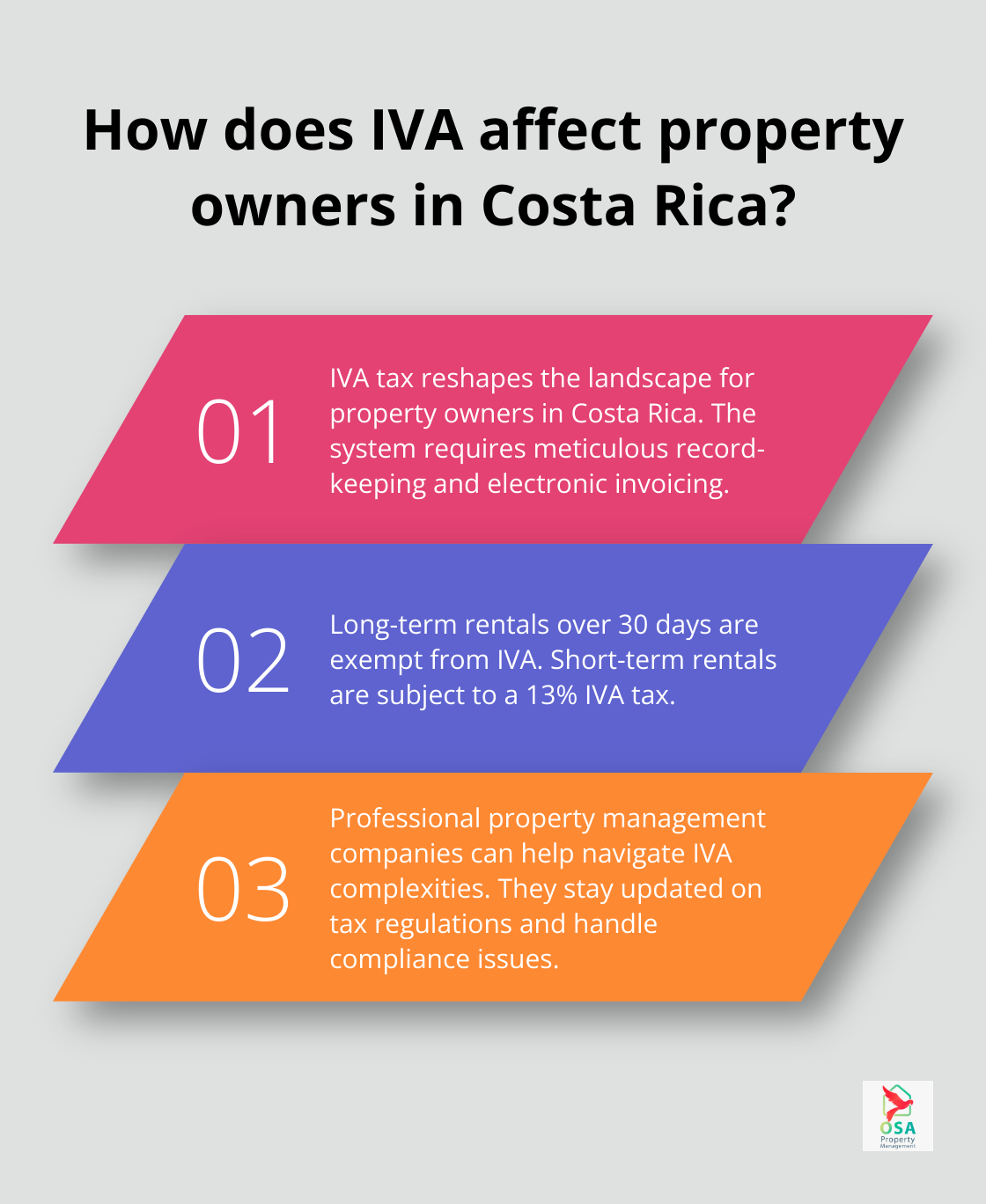

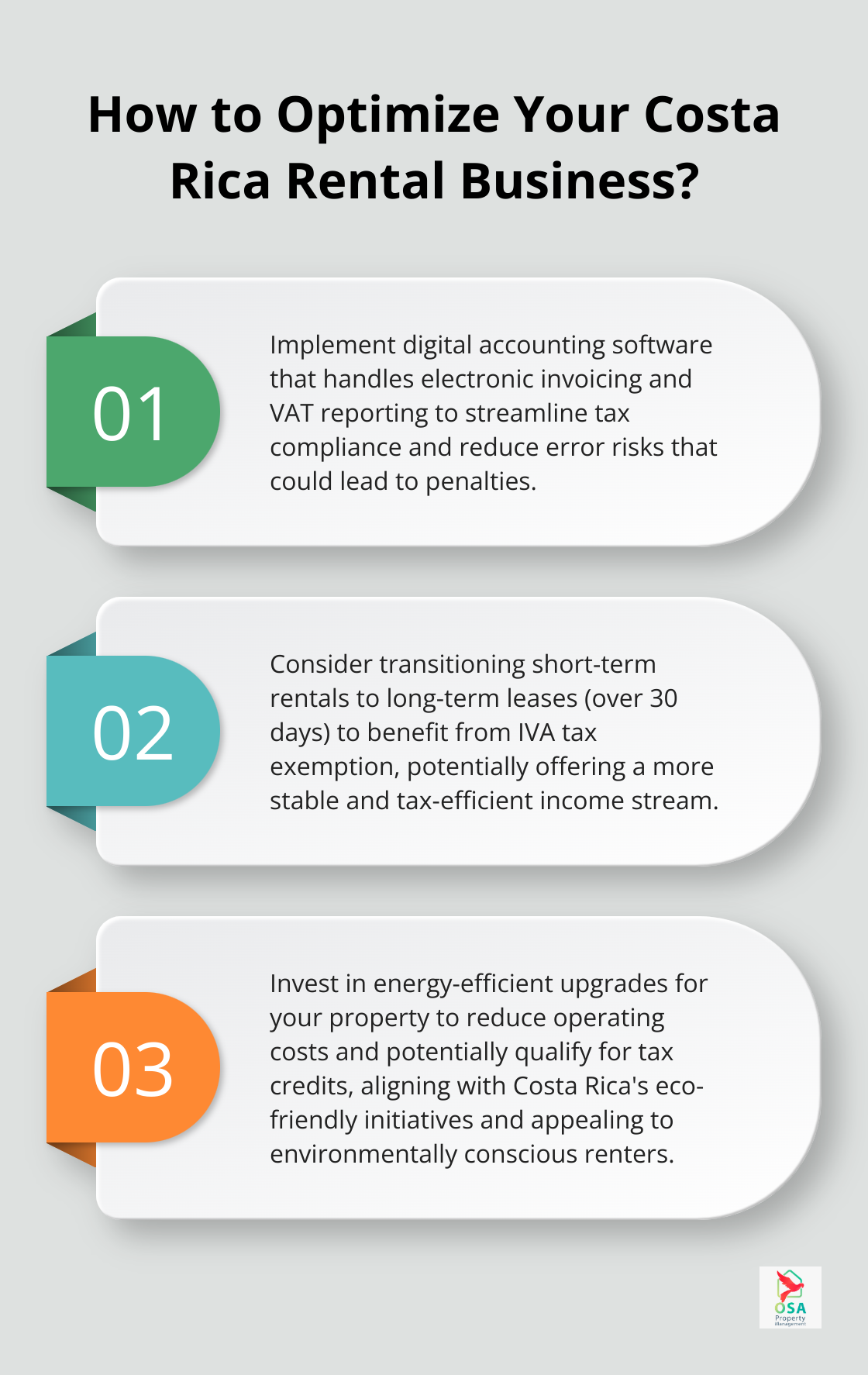

Costa Rica’s IVA tax reshapes the landscape for property owners, but effective management is possible with the right approach. The IVA system requires meticulous record-keeping. Invest in robust accounting software that handles electronic invoicing and VAT reporting. This investment streamlines your tax compliance process and reduces error risks that could lead to penalties. Costa Rica’s new invoice digitalization requirements are impacting businesses, and staying informed on compliance updates is crucial.

Optimize Your Rental Strategy

Consider tax implications when deciding between short-term and long-term rentals. Long-term rentals (over 30 days) remain exempt from IVA, potentially offering a more stable and tax-efficient income stream. For short-term rentals, factor the 13% IVA into your pricing strategy. Properties with transparent, tax-inclusive pricing often achieve higher booking rates.

Leverage Professional Property Management

Professional property management companies can help navigate IVA complexities. These experts stay updated on tax regulations and handle compliance issues. Osa Property Management, for instance, offers comprehensive services that include tax compliance, ensuring properties remain fully compliant with Costa Rican tax laws.

Explore Tax-Efficient Ownership Structures

The structure through which you own your property can significantly impact your tax obligations. Some property owners find that establishing a Costa Rican corporation for their property holdings offers tax advantages. This strategy requires careful consideration and professional advice to ensure alignment with specific circumstances and goals.

Invest in Energy-Efficient Upgrades

Costa Rica offers tax incentives for eco-friendly home improvements. Energy-efficient upgrades not only reduce your property’s operating costs but also potentially qualify for tax credits. This strategy aligns with Costa Rica’s commitment to sustainability and can enhance your property’s appeal to environmentally conscious renters (a growing demographic in the vacation rental market).

As Costa Rica’s tax policies evolve, property owners and investors should stay informed about income tax brackets to make smart decisions and optimize their tax strategies.

Final Thoughts

Costa Rica’s IVA tax has reshaped the landscape for property owners in the country. This value-added tax system impacts various aspects of real estate ownership, from rental income strategies to property management costs. The long-term implications of IVA for the Costa Rican real estate market include potential shifts in investment strategies and adjustments in property values as the market adapts to these new fiscal realities.

Property owners must stay informed about Costa Rica’s IVA and other tax regulations. The tax landscape changes, with potential updates that could impact investments. Regular consultation with tax professionals and property management experts will help navigate these complexities effectively.

Osa Property Management understands the intricacies of Costa Rica’s tax system and its impact on property owners. Our team stays up-to-date with the latest regulations to ensure our clients’ properties remain compliant and profitable. We offer comprehensive services tailored to the unique needs of each property owner in areas from Tarcoles to Uvita.