Navigating Costa Rica taxes can be complex, especially when it comes to rental income. At Osa Property Management, we understand the challenges property owners face in maintaining compliance with local tax laws.

This guide will explore why rental income tax compliance is crucial in Costa Rica and how it impacts property owners. We’ll also share insights on how professional management can simplify this often-daunting aspect of property ownership.

What Are Costa Rica’s Rental Income Tax Rules?

The Basics of Rental Income Tax

Costa Rica’s rental income tax system affects both local and foreign property investors. In 2025, the tax structure continues to evolve, reflecting the country’s commitment to fair taxation and economic growth.

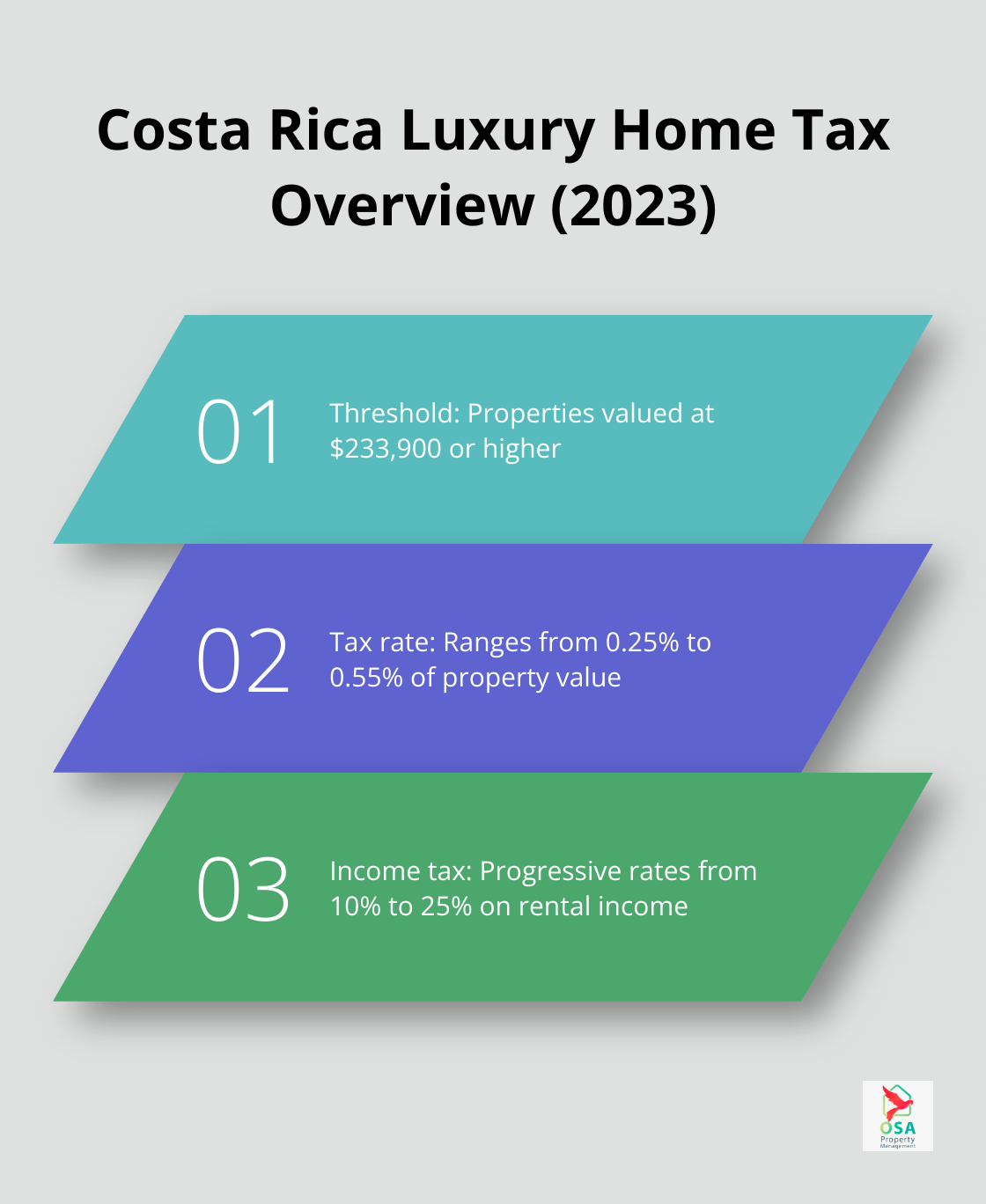

Rental income tax applies to all earnings from leasing properties, whether residential or commercial. Costa Rica has a luxury tax on high-value homes, with a threshold of $233,900 in 2023 and rates ranging from 0.25% to 0.55% based on the property value. Income above this threshold faces progressive tax rates from 10% to 25%, based on the total amount earned.

Short-Term vs. Long-Term Rentals: Tax Implications

The tax obligations differ significantly between short-term and long-term rentals. Short-term rentals (stays less than 30 days) incur a 13% Value Added Tax (VAT). This additional tax has prompted many property owners to reassess their rental strategies. Long-term rentals (exceeding 30 days) enjoy VAT exemption, making them an attractive option for those aiming to reduce their tax liabilities.

Property Types and Tax Considerations

All rental properties in Costa Rica (apartments, houses, condos, and commercial spaces) fall under income tax regulations. However, the tax treatment varies depending on the property’s use and the owner’s residency status. Non-resident property owners face a flat 15% tax on gross rental income without expense deductions. Residents, on the other hand, can leverage various deductions to lower their taxable income.

Compliance and Reporting Requirements

Property owners must adhere to strict compliance and reporting requirements. Monthly declarations of gross income (Form D-125) are mandatory to comply with Costa Rican tax regulations. Failure to submit these declarations can result in penalties and complications during annual tax returns.

The Role of Digital Platforms

Starting January 1, 2025, digital platforms in Costa Rica must collect and report Airbnb hosts’ names, earnings, and bank account details to tax authorities. This change emphasizes the need for accurate record-keeping and compliance among property owners. The use of digital accounting software (like QuickBooks Online or Xero) can simplify the tracking of rental transactions, expenses, and tax reporting.

Understanding these tax rules proves essential for property owners to make informed decisions about their investments. Professional property management services (like those offered by Osa Property Management) can help navigate these complex regulations, ensuring compliance and maximizing returns.

Why Tax Compliance Matters for Property Owners

Financial Consequences of Non-Compliance

Costa Rica’s rental income tax landscape presents numerous challenges. Property owners who neglect their obligations face serious consequences. Non-compliance results in hefty fines, back taxes, and potential legal action. In 2024, the Costa Rican government intensified its efforts to combat tax evasion, with interest charges on unpaid taxes and potential criminal charges for serious cases.

The financial impact of non-compliance extends beyond immediate penalties. Property owners who fail to meet their tax obligations may become ineligible for certain government programs or unable to secure loans for property improvements. In extreme cases, authorities may place liens on properties, severely limiting an owner’s ability to sell or refinance.

The Importance of Proper Tax Records

Keeping meticulous tax records is not just about avoiding penalties; it’s a smart business practice. Accurate records help property owners maximize deductions and minimize tax liabilities. For instance, tracking expenses related to property maintenance, insurance, and management fees can significantly reduce taxable income for resident property owners.

Moreover, well-maintained records streamline the tax filing process, saving time and reducing stress during tax season. They also provide a clear financial picture, enabling owners to make informed decisions about their property investments.

Effects on Property Value and Marketability

Tax compliance directly affects a property’s value and marketability. Prospective buyers often request tax history during due diligence. A property with a clean tax record is more attractive and can command a higher price. Conversely, properties with tax liens or a history of non-compliance may deter potential buyers or lead to lower offers.

In the competitive Costa Rican real estate market, a property’s tax compliance status can be a significant differentiator. Properties with clear tax histories often sell faster and at better prices. This is particularly true in popular areas like Jaco or Manuel Antonio, where investors are willing to pay a premium for hassle-free properties.

The Role of Professional Management

Given the complexities of Costa Rica’s tax system, many property owners turn to professional management services. Professional property management services can provide expert assistance with tax compliance and financial management. These services ensure that property owners stay compliant with local tax laws while optimizing their financial returns.

As we move forward, it’s clear that professional assistance can make a significant difference in managing rental income tax compliance. Let’s explore how Osa Property Management tackles these challenges head-on, providing peace of mind for property owners in Costa Rica.

How Osa Property Management Handles Tax Compliance

Streamlined Tax Reporting

Osa Property Management takes a proactive approach to tax compliance. Our system automatically generates monthly income declarations (Form D-125) for each property we manage. This ensures timely submission to Costa Rican tax authorities, which prevents potential penalties or complications during annual tax returns.

For short-term rentals, we track and report the 13% Value Added Tax (VAT) on stays less than 30 days. Our accounting software integrates with popular booking platforms, capturing all necessary data for accurate tax reporting.

Maximizing Deductions for Resident Owners

Resident property owners benefit from our comprehensive expense tracking. We document all deductible costs (including property maintenance, insurance premiums, and management fees). This detailed record-keeping often results in significant tax savings for our clients.

Navigating Complex Regulations

Costa Rica’s tax landscape can challenge non-resident property owners. We guide our clients through the nuances of the 15% flat tax on gross rental income for non-residents. This ensures they understand their obligations and avoid costly mistakes.

Our team also assists with property registration requirements. We ensure all properties receive proper registration with the National Tourism Registry and have the necessary municipal business licenses (patente municipal) for legal operation.

Adapting to Changing Regulations

The Costa Rican government frequently updates tax regulations. For instance, beginning January 1, 2025, digital platforms that make money for a portion of Costa Ricans will be required to start gathering data.

We develop strategies to help our clients adapt to these changes. Our team provides guidance on structuring rental agreements to optimize tax efficiency, such as considering the benefits of long-term rentals (over 30 days) which are exempt from VAT.

Expert Assistance for Peace of Mind

Osa Property Management offers expert assistance with tax compliance and financial management. We ensure that property owners stay compliant with local tax laws while optimizing their financial returns. Our team stays up-to-date with the latest regulations, providing peace of mind for property owners in Costa Rica.

Final Thoughts

Costa Rica taxes on rental income present complex challenges for property owners. Non-compliance can lead to severe consequences, including financial penalties and legal issues that impact investments. Professional property management services offer valuable benefits in handling tax compliance, ensuring all requirements are met while maximizing returns.

Osa Property Management understands the intricacies of Costa Rica’s tax landscape. Our team of experts provides comprehensive property management services that extend beyond daily operations. We handle all aspects of tax compliance, from accurate record-keeping to timely submission of required declarations.

Proper management of tax obligations protects and enhances the value of your investment. With the right support and expertise, you can navigate Costa Rica’s rental income tax landscape with ease. This allows you to fully enjoy the benefits of your property investment in this beautiful country.