At Osa Property Management, we’ve seen many property owners in Costa Rica face unexpected challenges due to inadequate insurance coverage.

Property insurance is a critical aspect of protecting your investment, but it’s not always as comprehensive as you might think.

This blog post will explore common pitfalls in Costa Rica property insurance, additional coverage options to consider, and how professional property management can help ensure you’re fully protected.

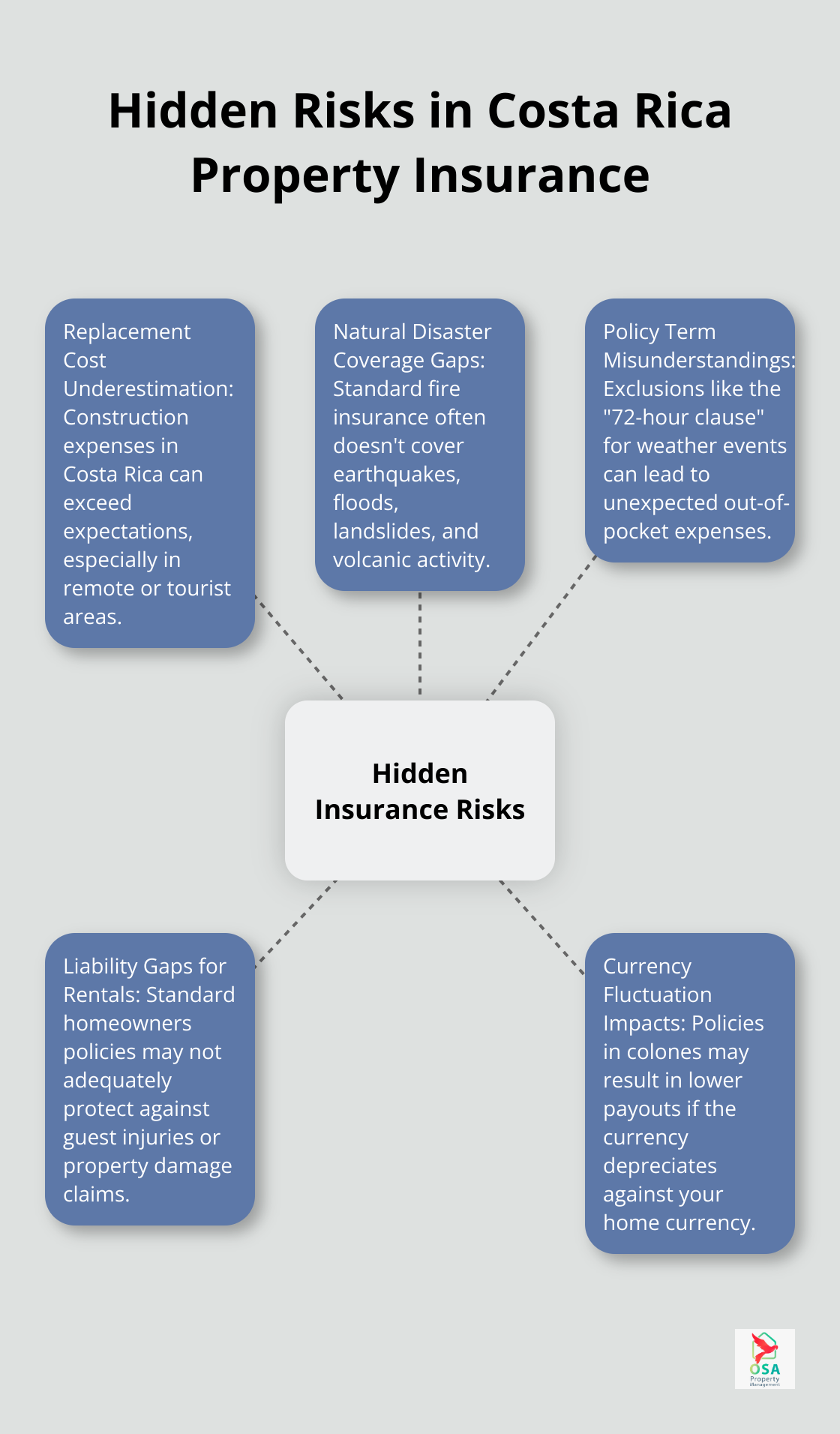

Hidden Risks in Costa Rica Property Insurance

Costa Rica’s property insurance landscape hides several pitfalls that can leave property owners exposed to significant financial losses. At Osa Property Management, we’ve observed numerous cases where inadequate coverage has resulted in devastating consequences.

The Replacement Cost Conundrum

A common mistake among property owners involves the underestimation of replacement costs. In Costa Rica, construction expenses can exceed expectations, particularly in remote or tourist-heavy areas. This shortfall can lead to substantial out-of-pocket expenses in the event of a total loss.

To mitigate this risk, we suggest obtaining a professional appraisal every few years. It’s crucial to consider not just the structure, but also costs for debris removal, architectural fees, and potential increases in building material prices (which can fluctuate significantly in Costa Rica’s market).

Natural Disasters: The Overlooked Threat

Costa Rica’s stunning landscapes come with inherent risks. According to recent data, Costa Rica experienced 24 earthquakes in a recent year, the highest number among Central American countries. Yet, many property owners fail to include comprehensive natural disaster coverage in their policies.

Standard fire insurance doesn’t suffice. Your policy should explicitly cover earthquakes, floods, landslides, and volcanic activity. The National Emergency Commission (CNE) has reported that in recent years, flooding alone has affected thousands of homes and infrastructure (a stark reminder of the importance of comprehensive coverage).

The Devil in the Details

Policy terms and conditions often present a minefield of misunderstandings. We’ve encountered cases where property owners believed they had coverage, only to discover during a claim that certain exclusions applied.

For example, many policies include a “72-hour clause” for weather-related events. This clause means damage occurring over a period longer than 72 hours may be treated as separate events, each subject to a deductible (potentially increasing your out-of-pocket expenses).

To navigate these complexities, we recommend working with a bilingual insurance broker or a property management company familiar with local insurance nuances. These professionals can help decode policies and identify potential gaps in coverage.

Liability Gaps for Rental Properties

Property owners who rent out their Costa Rica properties often overlook the importance of comprehensive liability coverage. Standard homeowners policies may not adequately protect against guest injuries or property damage claims.

It’s essential to secure a policy that specifically covers rental activities (including short-term rentals). This coverage should extend to common areas, swimming pools, and any amenities provided to guests.

Currency Fluctuations and Insurance Payouts

An often-overlooked aspect of property insurance in Costa Rica involves the currency in which policies are written and claims are paid. Policies denominated in colones (the local currency) may result in lower payouts if the colón depreciates against your home currency.

To protect against this risk, try to secure a policy that offers payouts in your preferred currency (usually US dollars for foreign property owners). This approach can help ensure that your coverage maintains its value over time.

As we move forward, we’ll explore additional coverage options that can provide a more comprehensive safety net for your Costa Rica property investment. These options will help you build a robust insurance strategy tailored to the unique challenges of owning property in this beautiful but sometimes unpredictable country.

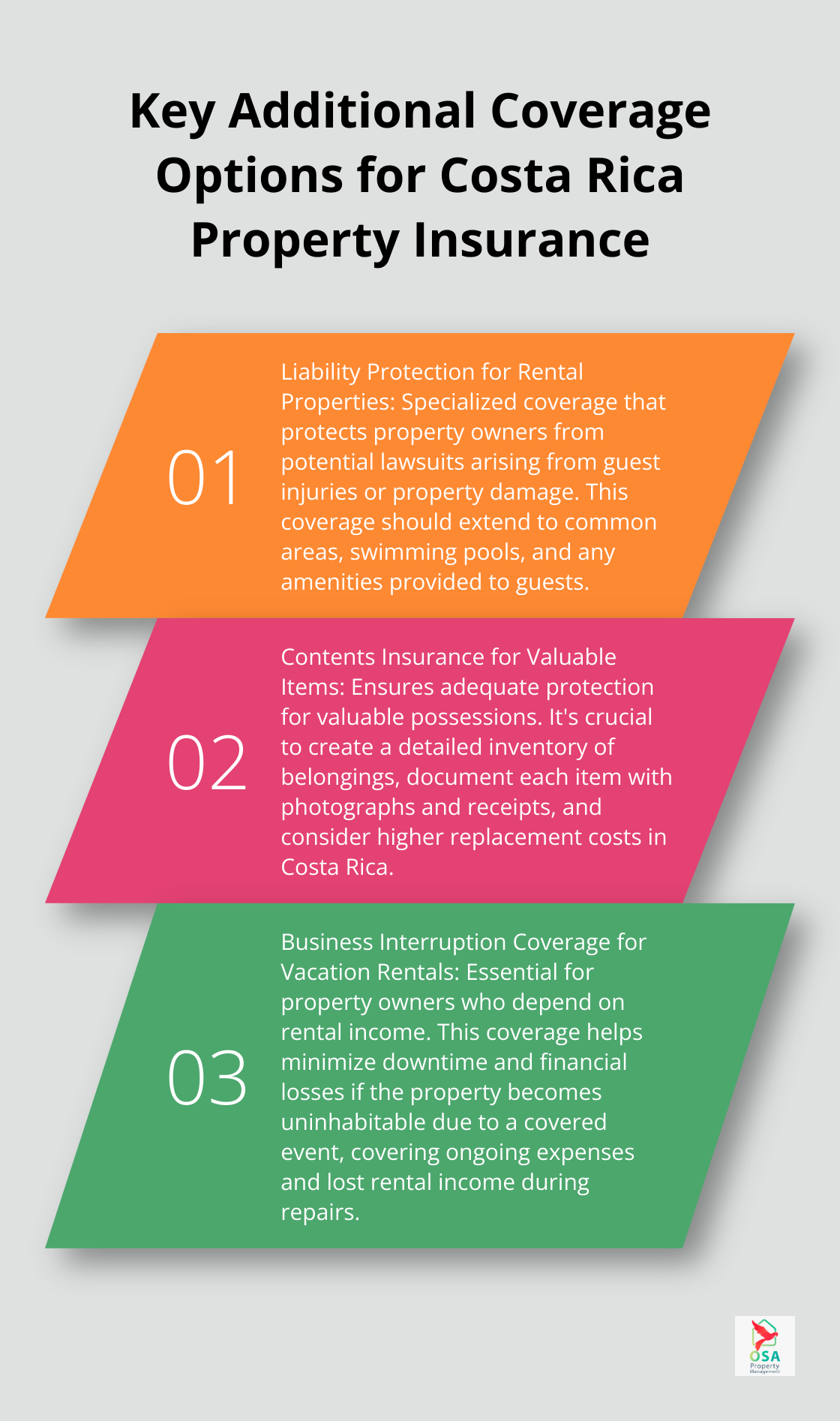

Enhancing Your Costa Rica Property Insurance

At Osa Property Management, we have identified several key areas where property owners in Costa Rica often need additional coverage. Let’s explore these important insurance options that can provide a more comprehensive safety net for your investment.

Liability Protection for Rental Properties

If you rent out your Costa Rica property, standard homeowners insurance might not suffice. You need specialized liability coverage that protects you from potential lawsuits arising from guest injuries or property damage. This coverage should extend to common areas, swimming pools, and any amenities you provide.

For instance, if a guest slips and falls on your property, you could face liability for their medical expenses and potential lost wages. Without proper coverage, you might incur significant out-of-pocket costs.

We recommend you work with an insurance provider experienced in vacation rental properties. They can help you determine the right amount of coverage based on factors like the size of your property, the number of guests you host annually, and any high-risk amenities you offer.

Contents Insurance for Valuable Items

Many property owners in Costa Rica underestimate the value of their belongings. Contents insurance is one of the two basic types of homeowners insurance in Costa Rica, alongside insurance for the building itself. This type of coverage ensures that your valuable possessions receive adequate protection.

When you consider contents insurance, create a detailed inventory of your belongings. Document each item with photographs and receipts where possible. This documentation will prove invaluable in the event of a claim.

Keep in mind that replacement costs in Costa Rica can exceed those in your home country (especially for imported items). Factor this into your coverage limits to avoid underinsurance.

Business Interruption Coverage for Vacation Rentals

If you depend on rental income from your Costa Rica property, business interruption coverage becomes essential. This type of insurance can help minimize downtime and financial losses if your property becomes uninhabitable due to a covered event.

For example, if a severe storm damages your property and renders it unrentable for several months, business interruption coverage can help cover your ongoing expenses and lost rental income during the repair period.

When you select this coverage, consider factors like your average occupancy rate and rental income. Work with your insurance provider to determine an appropriate coverage limit that aligns with your financial needs.

These additional coverage options can make a significant difference for property owners in Costa Rica. While they may increase your premium slightly, the peace of mind and financial protection they offer are invaluable. Don’t wait for a disaster to strike before you realize the importance of comprehensive coverage.

As we move forward, we’ll explore how professional property management can play a vital role in ensuring your insurance needs are met and your investment remains protected.

How Property Managers Enhance Your Insurance Coverage

Professional property management significantly impacts insurance coverage and overall property protection in Costa Rica. Property managers play a vital role in safeguarding investments beyond day-to-day operations.

Proactive Maintenance and Risk Mitigation

Property managers conduct regular inspections and maintenance, which prevent insurance claims. They address small issues promptly to avoid extensive damage that might lead to costly claims. Properties under professional management typically have fewer insurance claims compared to self-managed properties. This reduction in claims can lead to lower premiums over time, as insurance companies often reward claim-free periods with discounts.

Expert Navigation of Claims Process

When insurance claims become necessary, property managers prove invaluable. They document damage thoroughly, coordinate with adjusters, and oversee repairs. This level of involvement often results in faster claim processing and more favorable outcomes.

Staying Informed About Policy Changes

Insurance policies in Costa Rica can be complex, and terms often change. Property managers stay informed about these changes and can advise on necessary policy updates. They also help ensure coverage aligns with current property values and rental activities.

Leveraging Industry Relationships

Professional property managers often have established relationships with insurance providers and brokers. These connections can lead to better rates and more comprehensive coverage options. Their industry knowledge allows them to recommend specialized coverage options that property owners might not know about, such as protection from unique tropical risks in Costa Rica.

Customized Insurance Strategies

Property managers can develop tailored insurance strategies based on each property’s unique characteristics and the owner’s specific needs. They consider factors such as location (coastal vs. inland), property use, and local risk factors to create a comprehensive insurance plan. A thorough risk assessment of your property’s specific situation is crucial for proper rental property insurance in Costa Rica.

Final Thoughts

Property insurance in Costa Rica presents a complex landscape with significant risks for inadequate coverage. Many property owners face potential financial devastation due to underestimated replacement costs and overlooked natural disaster protection. Professional property management proves invaluable in navigating these challenges and ensuring comprehensive coverage for your investment.

At Osa Property Management, we understand the intricacies of property insurance in Costa Rica. Our team conducts regular inspections, assists with claims processing, and provides expert advice on policy updates and renewals. We leverage our industry relationships and local knowledge to develop customized insurance strategies that address the unique risks associated with your property.

Comprehensive property insurance, coupled with professional management, protects you from unforeseen events and ensures stable rental income. It allows you to enjoy your Costa Rica property without constant worry (and provides peace of mind for your investment). Don’t wait for a disaster to strike before securing adequate coverage for your valuable asset.